I Almost Died and Went Bankrupt from Stage 4 Metastatic Melanoma

By Gregory Ciola

By Gregory Ciola

March 11, 2022

Here Is What I Endured and How I Survived Financially

I came a hairs breath away from death because of metastatic melanoma in March 2021.

It started as a mole on my shoulder blade in 2016 that came back as melanoma. I was concerned, but it seemed like they caught it in time and I was told there wasn’t anything I needed to worry about. Fast forward two years later, it had spread to my right armpit, and in November 2019, it was diagnosed as Stage III Metastatic Melanoma. I underwent Immunotherapy in January of 2020. After three rounds, it almost destroyed my liver. I had to stop treatments and take prednisone for months.

In April of 2020, the doctors decided to remove the tumor. Thankfully, all the scans only showed the cancer under my armpit and nowhere else. When they surgically removed the tumor, the results came back clear. The report said, “No Viable Evidence of Metastatic Melanoma”. For the second time,I was certain that I won the battle, but that’s not what happened.

I had three PET scans and they were all clear. When I met with my doctor again in October 2020, he wanted me to wait six months for the next scan. That’s where this turned into a near death experience. Thankfully, my wife urged me to move the scan up and not wait six months. Instead of getting scanned in April, it was moved up a month.

The scan revealed a tumor in my brain. I was sent for an emergency MRI the next day, which was a Friday. On Monday, the doctor called and said I had a large hemorrhaging tumor that required immediate surgery. I went to the ICU at Advent hospital the next day. On Tuesday, they ran another MRI, and the tumor had grown twice in size since Friday. It is a miracle I am still alive. If they hadn’t caught this in time it would have killed me. If you would like to hear more about what I have gone through, be sure to watch this video I just released.

Here are a few pictures.

Here are a few pictures.

I’m not writing this article to just talk about my cancer battle. I am barely scratching the surface of what I went through. What I really want to share is what happened financially. This metastatic melanoma turned into the biggest financial crisis of my life. Not only did I battle for my life, but I also encountered serious financial troubles. I had to put my real estate business on hold and stop publishing a health newspaper that I had mailed for 18 years.

During one of my cancer treatments, I picked up a cancer magazine and saw a full-page ad from a company that helps people sell their life insurance policy. I had never heard of this! The company is Life Insurance Buyers located in Kansas City. Greg and Lisa Albers are the owners and they have been helping people who wish to sell their policy since 1995.

When I explained what I was going through with brain cancer, they told me there was a great chance they could help me. I filled out the application and sent them my health documents. Within a few weeks, they told me they had a buyer.I received over a six-figure amount that saved me from going bankrupt and losing everything. I’m still not out of the woods with cancer. However, I feel compelled to share this story with as many people as possible because there could be millions of people in a similar predicament. Cancer and health problems is the main cause of bankruptcy.

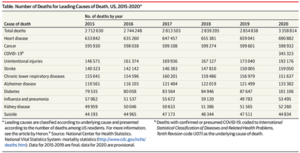

The figure below comes directly from the CDC. Cancer is the second largest killer in America, and many medical experts believe that these numbers are going to rise significantly over the next few years.

I was inspired to start Crossing Jordan Ministries and Cancer Warrior so I could share valuable information with others who are going through a cancer journey. We all know someone who is going through cancer, and they don’t have to face it alone.

I was inspired to start Crossing Jordan Ministries and Cancer Warrior so I could share valuable information with others who are going through a cancer journey. We all know someone who is going through cancer, and they don’t have to face it alone.

The following is an interview I conducted with Life Insurance Buyers. Please share this information with anyone you know who is diagnosed with cancer and facing financial hardship. Life Insurance Buyers is a resource who can help.

Q. What is a Viatical Settlement?

A. The sale of an existing life insurance policy by a third-party in which the insured is terminally or chronically ill. Terminally ill is typically defined as 24 months or less and is determined by a third-party life expectancy company. Chronically ill can be as high as 48 months.

Q. I had no idea someone could sell their life insurance policy for cash. Is it legal?

A. Over 90% of the country has never heard of this service, in fact, most insurance agents who sell life insurance products, have never heard of it. Yes, it is very legal to do. In 1911, a U.S. Supreme Court ruled a life insurance policy is considered your personal property (Grigsby vs. Russell), and like any other property, you can sell it, trade it, or give it away.

Q. I see a lot of ads on television about selling a life insurance policy.

A. It’s first important to understand the difference between a Broker vs. a Provider. Companies on TV are licensed to represent investors, not policy owners. They are a Provider, and their objective is to pay the lowest amount possible for a policy without competition. Life Insurance Buyers is a Broker, and their fiduciary obligation is to the policy owner. A broker, like Life Insurance Buyers, works on behalf of the policy owner and creates a competitive auction process with multiple investors.

Q. Why should I work with a Broker, like Life Insurance Buyers?

A. We strongly recommend working with a licensed viatical settlement broker rather than directly with a buyer (Provider). Life Insurance Buyers is licensed in all states that regulate viatical settlements. As a broker, we will shop your policy to multiple licensed buyers and provide you with several offers to choose from. This competitive bidding process means that you will get the most for your policy. And unlike direct buyers (Providers), we can provide you with access to multiple offers and funding choices.Since 1995, Life Insurance Buyers has helped over 3,000 families across the country to secure funds that help them when they need it most. We’ve earned the reputation of a trusted resource in the settlement industry.

Q. Should I work with more than one Broker?

A. To maximize your policy’s value, it’s always best to work with only one broker since buyers tend to avoid policies they have received from multiple brokers. We will never ask you to sign an exclusive agreement with us. However, since we incur significant costs to underwrite and market your policy, we do ask for your loyalty throughout the process. Think of it as if you were selling your house, you wouldn’t hire 6 realtors to sell your house, you would hire the best one to get the job done.

Q. Are Viatical Settlements regulated?

A. Viatical settlements are currently regulated in most states (42). Most state insurance departments have regulations in place to protect the consumer/policyholder and to ensure agents/brokers/providers comply to strict standards and ethical practices. Typically, licensing and oversight is handled by a state’s department of insurance. For more information on how your state regulates viatical settlements, refer to your state department of insurance website or contact us. We’d be happy to discuss any and all of your questions!

Q. What types of life insurance policies are eligible to be sold?

A. Universal Life, Whole Life, Variable Universal Life, Group Life, FEGLI and Term Life policies issued by U.S. based insurance companies.

Q. How much should the policy’s face value be?

A. Generally, a policy with a face value of $50,000 or higher is eligible for a viatical settlement.

Q. How much is my policy worth?

A. Since individual policy amounts, premiums and life expectancies vary, it is difficult to set a standard amount. After a brief consultation, we can generally provide you with an estimate range of your policy’s value.

Q. Are there restrictions on how I can spend the proceeds?

A. There are NO restrictions on how the proceeds from a viatical settlement can be used.

Q. Are the proceeds from a viatical settlement taxable?

A. Generally, the proceeds are not taxable. In 1996, the Health Insurance Portability and Accountability Act (HIPAA) exempted viatical settlement proceeds from income and capital gains tax. With that being said, Life Insurance Buyers does not provide tax advice. So, you should always speak with your tax professional for more information.

Q. What does it cost me to do a viatical settlement?

A. Life Insurance Buyers does not charge any fees to our clients, and there are no hidden fees/up-front costs. If at any point you aren’t satisfied with the offers we present, you are free to walk away at no obligation or cost to you. If you accept an offer, our fee will be paid directly by the purchaser through the escrow agent after the transaction closes.

Q. How long will it take me to get the proceeds?

A. Depending on your state’s laws, funds are typically released from escrow within 72 hours of the buyer’s receipt of confirmation of change of ownership and beneficiary rights from the insurance company.

Q. Will I have to pay premiums after my policy is sold?

A. No. Once you receive your proceeds, you will have no future premium obligations whatsoever.

Q. How long does the viatical settlement process take?

A. Life Insurance Buyers can provide a range of potential value with some policy and medical information within a day or two. The entire process takes on average about the same amount of time as selling your house (30-45 days). Life Insurance Buyers is dedicated to working diligently and with a sense of urgency to deliver quick results to all of our clients that we serve.

Q. How do you suggest anyone reading this interview can learn more?

A. Call our toll-free number at 1-800-936-5508 and ask for Greg or Lisa Albers. You can also visit our website.

Be sure to check out our website:, and read my book “The Battle for Health is Over pH; Alkaline vs. Acid, Life & Death Hangs in the Balance.”

© 2022 Gregory Ciola – All Rights Reserved

E-Mail Gregory Ciola: crossingjordan77@gmail.com