The 28th Amendment to the U.S. Constitution

In 1848 Karl Marx wrote The Communist Manifesto advocating a heavy “progressive income tax” as the means to destroy freedom and capitalism. By 1913 his tyrannical philosophy had reached America and resulted in passage of the 16th Amendment to our Constitution. It was the beginning of the end of the American Republic. Bolstered by this huge taxing power, the federal government has been able to grow into the Godzilla monster that dominates our lives today.

But thankfully millions of Americans now wish to do away with progressive tax rates. The 2014 Reason-Rupe poll showed that 62% of Americans favor a “flat tax,” or what we at AFR term an “equal-rate tax.” The following essay will show how we can bring this about.

The present tax reform bill that President Trump and our Republican Congress are now working to get passed in Washington is a good start toward a new found rationality in the halls of the capitol city. But it is far from what is truly needed to stop the malignancy of domination that government has become.

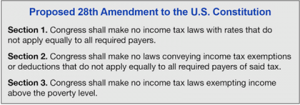

If we are to stop the runaway growth of government in America, we must end the source of that growth – “progressive tax rates” and their redistribution of wealth. AFR’s 28th Amendment plan does precisely that. Here is the wording for the amendment:

This amendment will create “equal rights under the law” for our tax code. Equal rights mandate equal rates. This is the fundamental basis of America. This means ending all special breaks, exemptions and rate progressivity.

This will necessitate the adoption of a simple 15% equal-rate income tax that ends the usage of all legal favors and loopholes. Period. The only exemption that would qualify would be our standard deduction of approximately $6,000, granted to everyone, which would exclude all Americans below the poverty level from being taxed.

Such a 15% equal-rate tax would mean that the millionaire would have to write a check for $149,100 dollars ($1,000,000 income minus $6,000 = $994,000 X .15 = $149,100). He would not be able to use expensive accountants and loopholes to reduce his bill to zero.

Likewise the man who earns $10,000 dollars would have to write a check for $600 dollars ($10,000 income minus $6,000 = $4,000 X .15 = $600). He would not be able to use egalitarian sophistry and progressive tax rates to reduce his bill to zero.

“Simplify, simplify, simplify,” said Ralph Waldo Emerson in the 19th century. This is what an equal-rate tax will do for us. It will purge the convoluted briar patch of idiocy and greed that comprises today’s Washington / Wall Street corporatism, and which is propelling our lives into the madness of dictatorship with every passing decade.

Opposition to an Equal-Rate Income Tax

The major objection liberals make to equal-rate taxation is that it will “place a burden on low-income earners who pay minimal taxes.” But this is not true. It will NOT impose a net burden on them at all. In fact it will do just the opposite.

Here’s why. Because of its huge simplification of our tax code, an equal-rate tax will save American industry billions of dollars annually in compliance costs. This will greatly lower the costs of goods and services for all citizens.

An equal-rate tax will also restore annual real wage growth, which we haven’t had in America in 45 years. And if we also combine an equal-rate tax with Milton Friedman’s 4% auto-expansion plan for the Federal Reserve and the money supply, we would create a huge annual increase in the standard of living for everyone.

It is not possible to explain the details of this in the space permitted, but AFR has published an 11-page Tax Report that explains the reasons for this thoroughly in layman’s language.

To sum all this up, an equal-rate income tax will light up the sky of economic productivity in this country. Everyone (rich, poor, and in between) will receive a higher standard of living with this much needed reform. Moreover, everyone’s lives will be so much simpler. Our monstrous tax code could be reduced from 17,000 pages to one or two pages. America’s relentless march toward ever-bigger government would be ended. The American Republic would be saved.

The Moral Component

It’s very important to understand, this is not just an immensely practical cause that is needed for the country; it is also a profoundly moral cause. Think back to the 1840s and 1850s when the northern abolitionists were fighting against slavery. Their leaders took a vehement moral stand on the principle of EQUAL RIGHTS UNDER THE LAW. They proclaimed that black people had the same right to their freedom as white people, which is what carried the day and won the cause of freedom for them.

Well, that same principle exists today in the tax arena. Productive people have the same right to their income as less productive people do. We are all supposed to be equal under the law in America. We who are productive are no different than those who are less productive. Progressive tax rates are unjust, unconstitutional, and immoral.

Some have asked, why do we need a constitutional amendment, which may require 8-10 years to ratify? Why not just work to pass an “equal-rate tax” into law? The reason is that launching the 28th Amendment to the Constitution greatly dramatizes the issue. It makes it a matter of morality and constitutionality. In addition it makes it impossible for liberals to go back to “progressive rates” when they get into power.

But the most important aspect of employing an “amendment strategy” is that we can attack the present tax code as “immoral and unconstitutional.” All lofty aims of history have a MORAL connotation to them. Tax reform is no different. We have to make use of this crucial aspect.

Radical tax reform is the great unifying cause that can break the stranglehold collectivism has over our country’s politics. Americans are ready to scrap “progressive tax rates.” Yet this monumental reform will not happen unless conservatives, libertarians and independents unify behind this vital revolutionary issue with moral fervor.

Just lobbying for the practicality of a flat tax will never bring us victory. This is the big mistake of America’s tax reformers over the past 50 years. They have fought only a practical battle with mundane activism and dreary statistical seminars. Taxation is the nefarious power of tyranny; it requires a heroic challenge of the forces of evil. Visualize the power of the lone Chinese citizen standing in Tiananmen Square in 1989 against the ominous column of tanks before him. Visualize the patriots of early America relentlessly stumping the towns and taverns and churches to sell the Constitution to their fellow citizens. That is the kind of courage and commitment that will be required from us.

To learn more of this cause and how to bring it about, see AFR’s 11-page Tax Report, “Ending Progressive Tax Rates in America.”

The ultimate goal is to end the hated income tax itself, which our Tax Report demonstrates how to accomplish. But no historic revolution descends upon a country instantly; it proceeds in steps. The first step for such a dramatic goal as actually ending the income tax must be to first end the Marxian policy of wealth redistribution and implement into our tax system a structure of objective law, i.e., equal rights under the law.

This means no privileges and special favors for anyone above the poverty level. America was not meant for sluggards. She was meant for stalwart men and women of principle who desire to get out of life only what they are willing to put into life. We need to do much better than the Republicans and quislings such as Paul Ryan are promising to do. We need to find again the sublime idealism that our Founders instilled into this country, and which lasted until that fateful year of 1913. We need to end “progressive tax rates” in America unequivocally without apology.

© 2017 Nelson Hultberg – All Rights Reserved